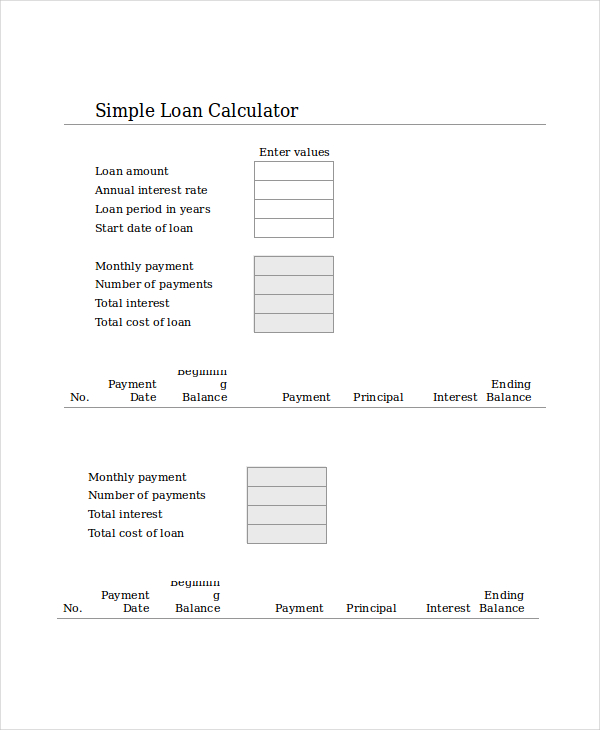

Loan Amount: This is the amount of money that you are borrowing. When calculating your loan payments, you will need to pay attention to the following: Enter your own numbers into the loan calculator to match your loan type. Personal loans, mortgages, car loans, student loans, credit card debt, and payday loans will differ in their default loan amounts, payment frequency, and rates. The loan calculator can be customized to find the payment amount for different types of loans. This lets you know how much the loan will really cost. It will also give you the total interest that you will pay, and your total lifetime payment. This loan calculator can be used to find your estimated loan payment based on your interest rate, borrowed amount, and term length. The amount you'll need to pay each month will depend on the size of your loan, how long you have to pay it back, and the interest rate. When payment and compounding frequencies differ, we first calculate theĮquivalent Interest Rate so that interest compounding is the same as payment frequency. We use this equivalent rate to create the loan payment amortization schedule.When you take out a loan, you'll need to make regular payments to pay it back. If you have an existing loan input remaining principal, interest rate and monthly payment to calculate the number of payments remaining on your loan. Input different payment amounts for a loan to see how long it will take you to pay off the loan. Input loan amount, number of months required to pay off the loan and payment amount to calculate the interest rate on the loan. If you have an existing loan, input your interest rate, monthly payment amount and how many payments are left to calculate the principal that remains on your loan. Try different loan amounts to see how it affects the required monthly payment.

Loan payment table to easily compare principal and interest amounts. Try different loan scenarios and create and print an amortization schedule or create a

Find your ideal payment amount by changing loan amount, interest rate, and number of payments in the loan. Calculator OptionsĬalculate the payment required for your loan amount and term. Payment Amount The amount to be paid on the loan at each payment due date. Number of Payments ÷ Payment Frequency = Loan Term in Years. Payment Frequency How often payments are made each year. Number of Payments The number of payments required to repay the loan. If compounding and payment frequencies are different, this calculator converts interest to anĮquivalent rate and calculations are performed in terms of payment frequency. Compounding The frequency or number of times per year that interest is compounded. Interest Rate The annual nominal interest rate, or stated rate of the loan. Loan Amount The original principal on a new loan or principal remaining on an existing loan. You can also use ourīasic loan calculator which assumes your loan has the typical monthly payment frequency and monthly interest compounding. Create and print a loan amortization schedule to see how your loan payment pays down principal and bank interest over the life of the loan.Ī key feature of this calculator is that it allows you to calculate loans with different compounding and payment frequencies. Use this calculator to try different loan scenarios for affordability by varying loan amount, interest rate, and payment frequency. Calculate loan payments, loan amount, interest rate or number of payments.

0 kommentar(er)

0 kommentar(er)